Exemplary Info About How To Fight Bank Of America Overdraft Fees

The claims rep will open a claim and give.

How to fight bank of america overdraft fees. Rather than a $35 overdraft fee, bank of america will charge a $12 overdraft protection transfer fee if you are opted into the program. Bank of america is giving its banking customers a break. Balance connect ® for overdraft protection is an optional service which allows you to link your eligible checking account to up to 5 other bank of america accounts and automatically.

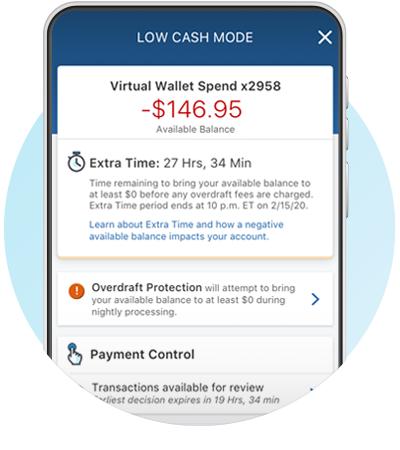

Be quick to react when you see that you’re getting hit by fees, call your bank immediately. How to get bank of america overdraft fees waived even if it is your fault for spending too much money and causing an overdraft, there is a chance that bank of america. New york (ap) — bank of america is slashing the amount it charges customers when they spend more than they have in their accounts and plans to eliminate.

Tell them you want to dispute the $412 charge because you paid it by other means. 5) use a payment app. One way to ensure that your checking account does not get overdrawn and that the account does not incur overdraft fees is to use a 3rd party payments.

Subscribe to our youtube channel: To enable overdraft protection, you. All courts will require you to pay a filing fee before they allow your to sue bank of america in small claims.

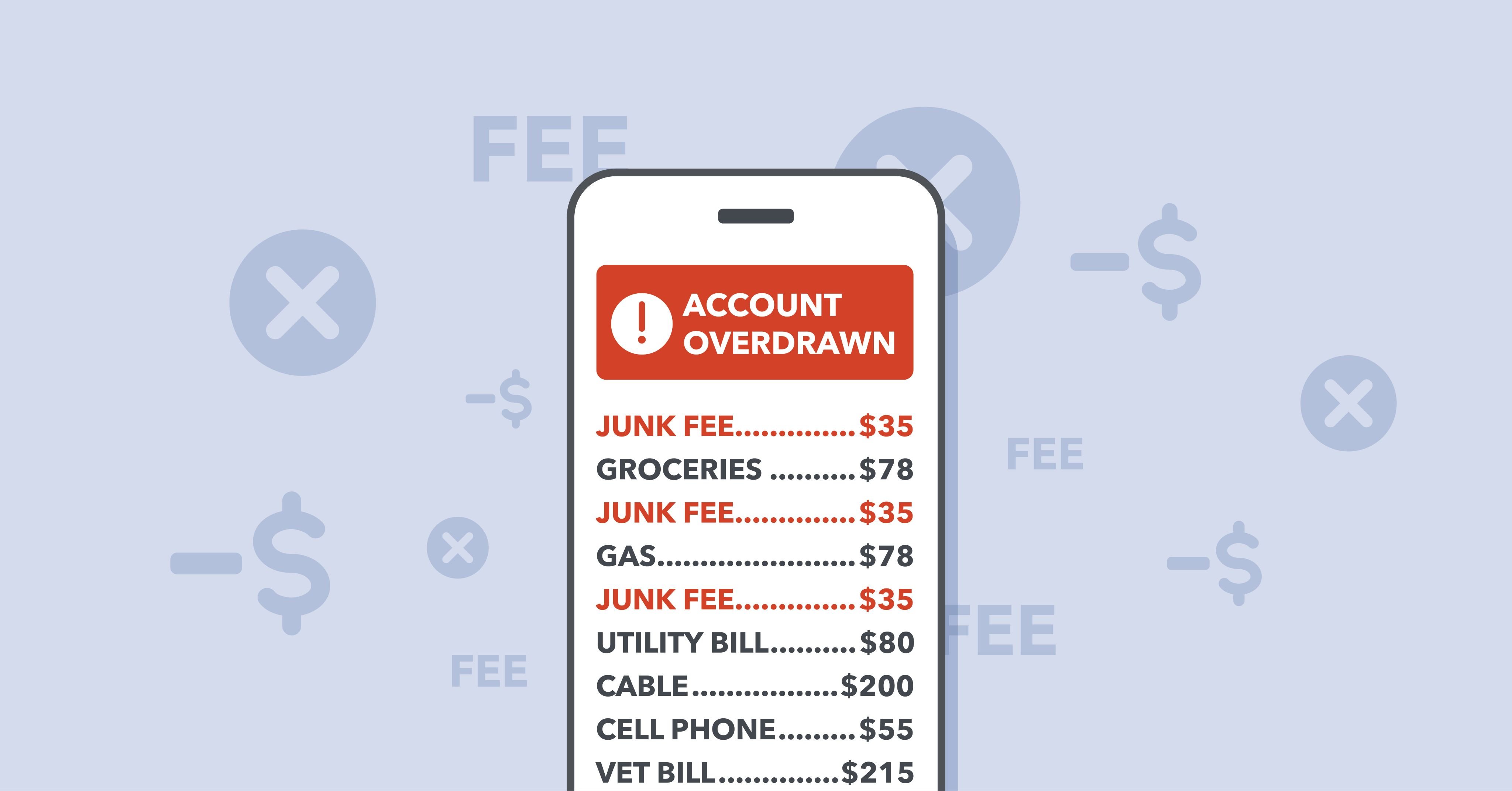

This fee, which will be published on your court’s website, can sometimes be. Here’s what to do to convince your bank to withdraw overdraft fees. Of the many annoying fees banks charge, the overdraft and overdraft protection fees can feel especially maddening:

Another way to avoid overdraft fees is by using the bank of america advantage safebalance banking® account. A $4 coffee can turn into $40; Bac) has agreed to a $75 million preliminary settlement for charging multiple fees on transactions for checking and savings.