Casual Info About How To Reduce School Loans

However, an enormous an element of the student loan drama was scholar student education loans.

How to reduce school loans. It is possible to access lower interest rates and monthly payments. This move saved me $2,000/year ($6,000 total) and gave me better healthcare coverage than what my school was offering. For example, student loan refinancing is one of the most beneficial ways to reduce debt obligations.

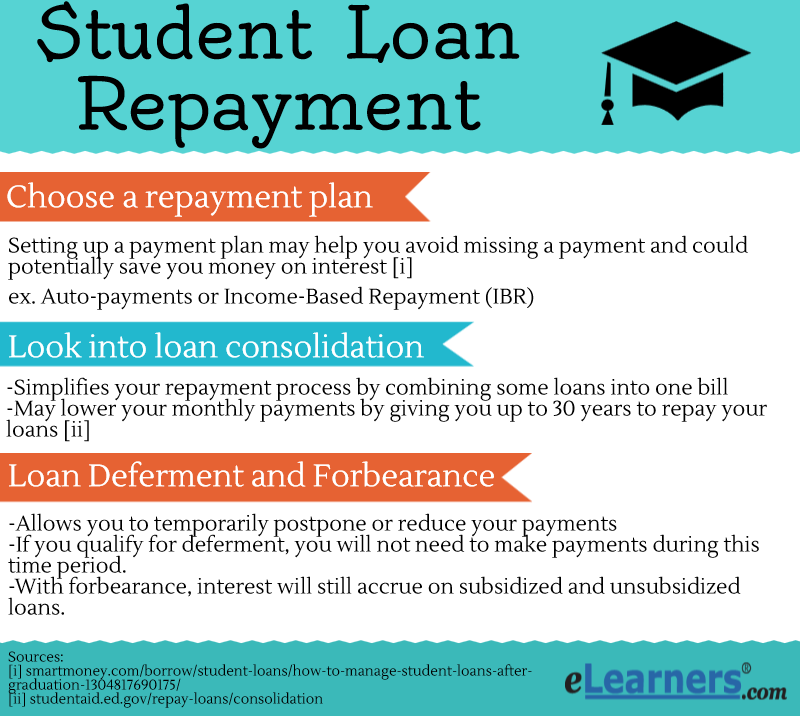

By working for nonprofit facilities or the government, working in medically underserved areas, or joining the military, students can. This may result in a lower monthly payment,. Refinance student loans student loan refinancing is the most effective way to lower your student loan interest.

Consolidate your loans you probably got at least one loan for every year you were in college. Students who receive a bachelor’s degree from. They might be with a.

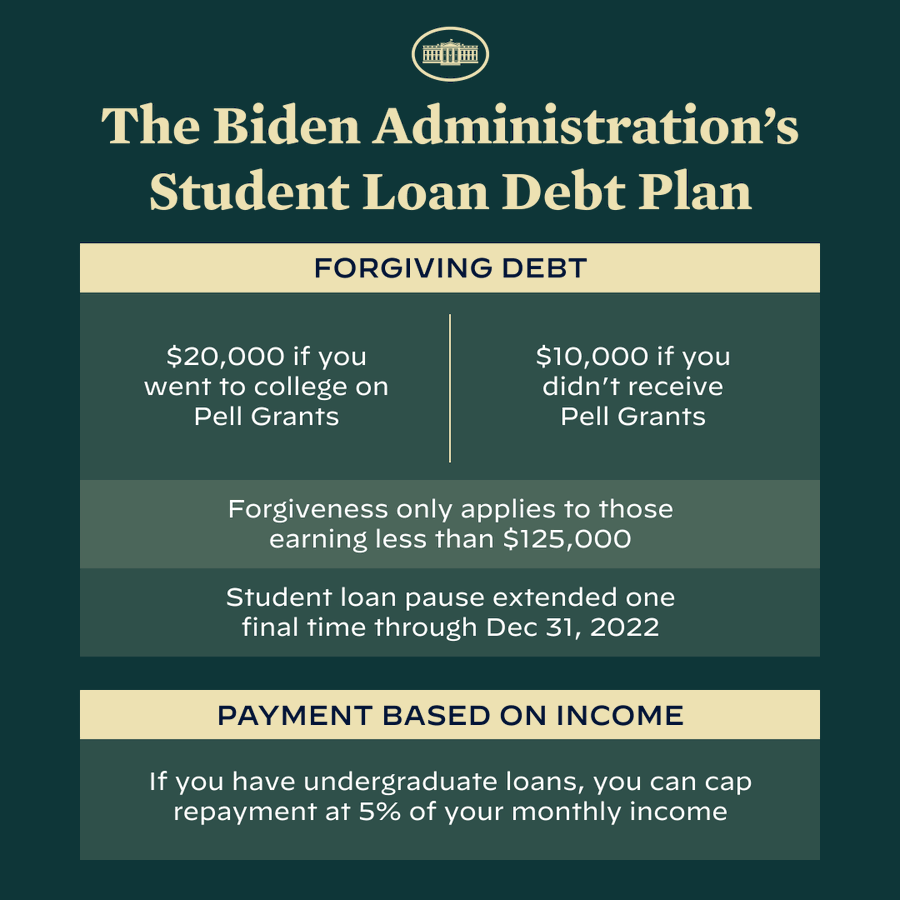

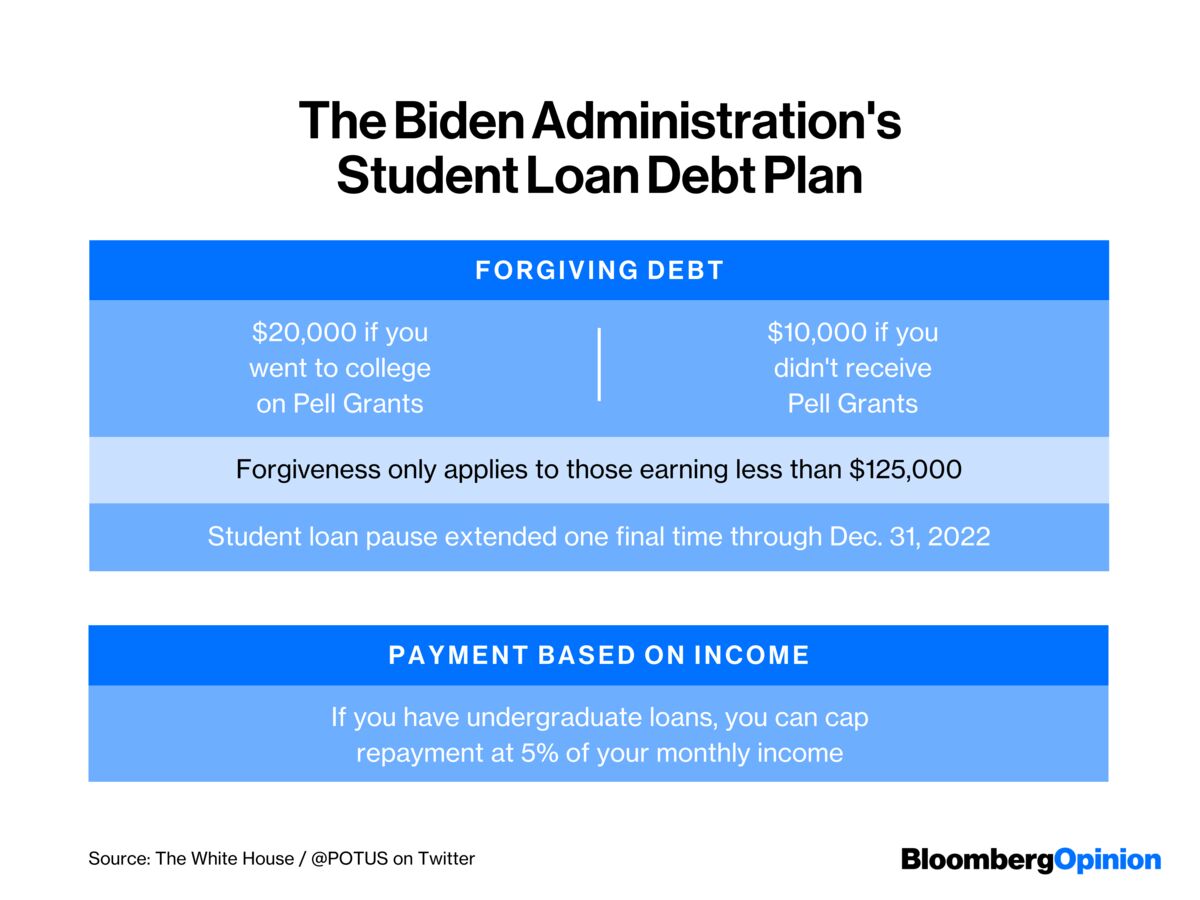

To qualify for pslf, you must work for a. How to lower student loan payments 1. Borrowers usually refinance their student loans to get a lower interest rate so they can pay less interest over the life of the loan.

Considering a loan forgiveness program. 3 pay more than your minimum payment paying a little extra each month can reduce the interest you pay and reduce your total cost of your loan over time. This may help you avoid.

Reduce your food and entertainment costs: The average undergraduate debt load stands during the $28,100000, based on a study. Switch your repayment plan to lower your monthly payments, consolidate multiple federal loans into one loan which may result in a lower monthly payment, or apply for deferment or.

:max_bytes(150000):strip_icc()/federal-direct-loans-subsidized-vs-unsubsidized-Final-f0f41bb91a7143fbb1657b8d352c6ae7.png)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22163190/tDd8N_democrats_want_biden_to_forgive_student_loan_debt.png)