Peerless Info About How To Settle A Loan

Lenders are often willing to settle equity loan debt for a fraction of the balance.

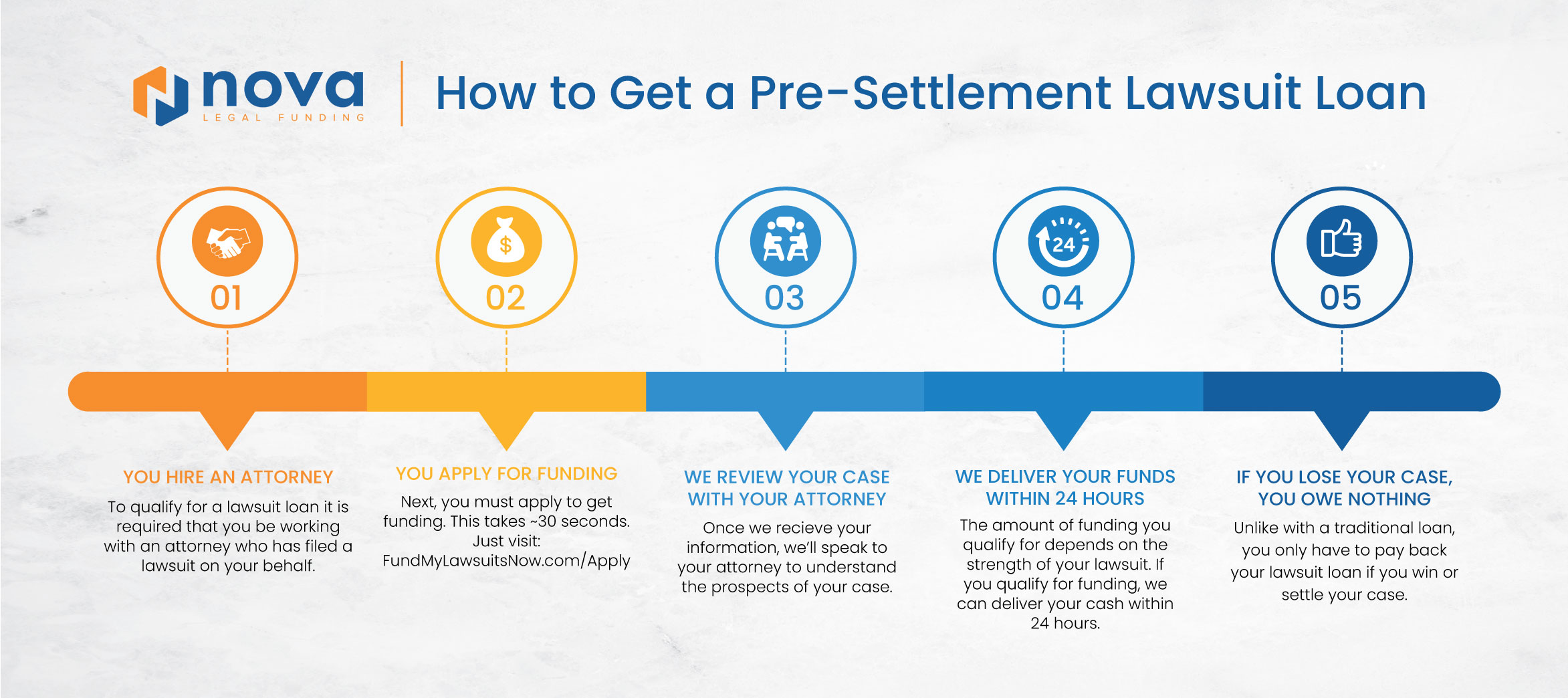

How to settle a loan. Unlike traditional loans, settlement funding from tribeca doesn’t require a credit check or any of the other infamous red tape. This could be a lump sum or a number of payments. There are two main ways to settle a debt:

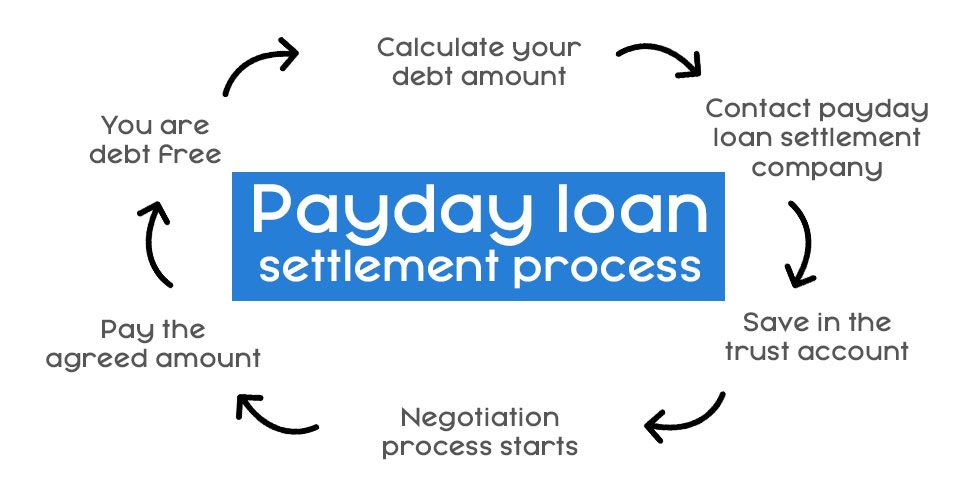

Make a payment to settle the loan using the instructions provided. Since this is outside of your normal payment plan, you’ll need to handle a settlement carefully. Income proof (salary slip, form 16, itr filing) 6 months bank statement.

You’ll need to figure out what your settlement options are. Life won't wait for your settlement. Who can help you negotiate student loans negotiate yourself.

Loan settlement works by negotiating with creditors to pay off a debt for less than the full amount. Owe nothing if you lose your case. You can only settle a student loan if its in default or near it.

Lump sum or monthly payments. Our simplified funding means only three things. Get an offer in writing and have a lawyer review the terms with you.

Basically there are three ways to settle your loan earlier: Go directly to your lender and ask for a payment arrangement. Availing of the personal loan helps you in two ways, first, your credit score.