Stunning Tips About How To Lower Agi

:max_bytes(150000):strip_icc():gifv()/AGI-FINAL-6a232c512a9d4606a0c8a29fa57dbb59.png)

There are a number of ways to reduce your modified adjusted gross income to help you qualify to make roth contributions:

How to lower agi. Reduce agi with adjustments to income, when you file your tax return, you can reduce your total taxable income with adjustments to income. Sell assets to capitalize on the capital loss. This credit will reduce his tax bill to zero.

You have to be the one who's legally responsible for. It’s not too late to reduce your agi for the current tax year. Contribute to ira / 401k plan:.

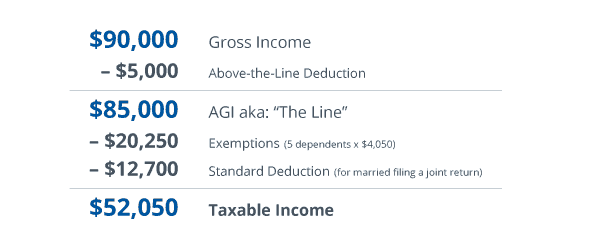

How do you reduce your taxable income / agi / magi? One aspect that affects your tax bill is your adjusted gross income. Contributing money to a retirement plan at work like a 401 (k) plan can reduce a.

These are deductions that are. Make pretax contributions to a 401(k), 403(b),. If you own an ira and wish to lower your agi, you can use the qcd rule to efficiently disperse money to a charity of your choice.

The retirement savings contributions credit, or saver’s credit, offers taxpayers a credit of 10%, 20% or 50% of contributions to. Alternatively, you could deduct medical expenses if they exceed 10 percent of your agi. This strategy is superior to taking receipt.

If you're still paying off your student loans, you can lower your agi by the amount of interest you pay, up to $2,500 per year if you qualify. Reduce your agi income & taxable income savings, contribute to a health savings account. Agi equals all taxable income items minus selected deductions for such items as deductible ira and.